Proven Approaches for Developing a Tailored Debt Management Strategy to Accomplish Financial Flexibility

In the mission for financial flexibility, the importance of a well-crafted financial debt monitoring plan can not be overemphasized. The journey in the direction of accomplishing a debt-free life is a meticulous procedure that requires careful factor to consider and calculated preparation. By carrying out proven techniques customized to your unique financial circumstance, you can pave the means for a much more safe and secure and stable future. From analyzing your current financial standing to establishing possible goals and exploring debt consolidation choices, each step plays an important duty in assisting you in the direction of your ultimate monetary goals. Nevertheless, the crucial lies not only in the initial formulation of a plan but likewise in the recurring monitoring and required modifications needed to stay on program.

Assessing Your Current Financial Circumstance

Examining your existing financial standing is a crucial first action towards accomplishing long-term monetary stability and freedom. By conducting a thorough evaluation of your income, responsibilities, expenses, and assets, you can get a clear understanding of your general financial wellness.

Additionally, it is important to analyze your assets, such as interest-bearing accounts, retired life funds, and home, along with any type of exceptional debts, consisting of bank card financings, home loans, and balances. Determining your total assets by deducting your responsibilities from your assets supplies a snapshot of your economic position. This thorough analysis establishes the structure for creating a personalized debt monitoring plan customized to your specific monetary situations.

Establishing Sensible Financial Obligation Settlement Objectives

To accomplish monetary flexibility, establishing sensible financial obligation payment purposes is important for individuals seeking to regain control of their financial resources. Setting realistic debt settlement objectives involves a tactical method that thinks about both lasting and temporary economic targets.

When setting debt settlement objectives, it is vital to be particular, measurable, achievable, pertinent, and time-bound (CLEVER) For instance, aim to settle a specific amount of financial obligation within a specific duration, such as decreasing charge card debt by $5,000 within the next 6 months. Breaking down bigger goals right into smaller sized landmarks can aid track progress and preserve motivation.

In addition, consider readjusting your costs behaviors to assign more funds in the direction of financial obligation repayment. Producing a budget plan that lays out expenditures and income can highlight locations where financial savings can be made to accelerate debt payback. Frequently evaluating and changing your financial obligation payment goals as needed will make certain ongoing progression in the direction of economic freedom.

Creating a Personalized Budget Plan Plan

Checking Out Debt Loan Consolidation Methods

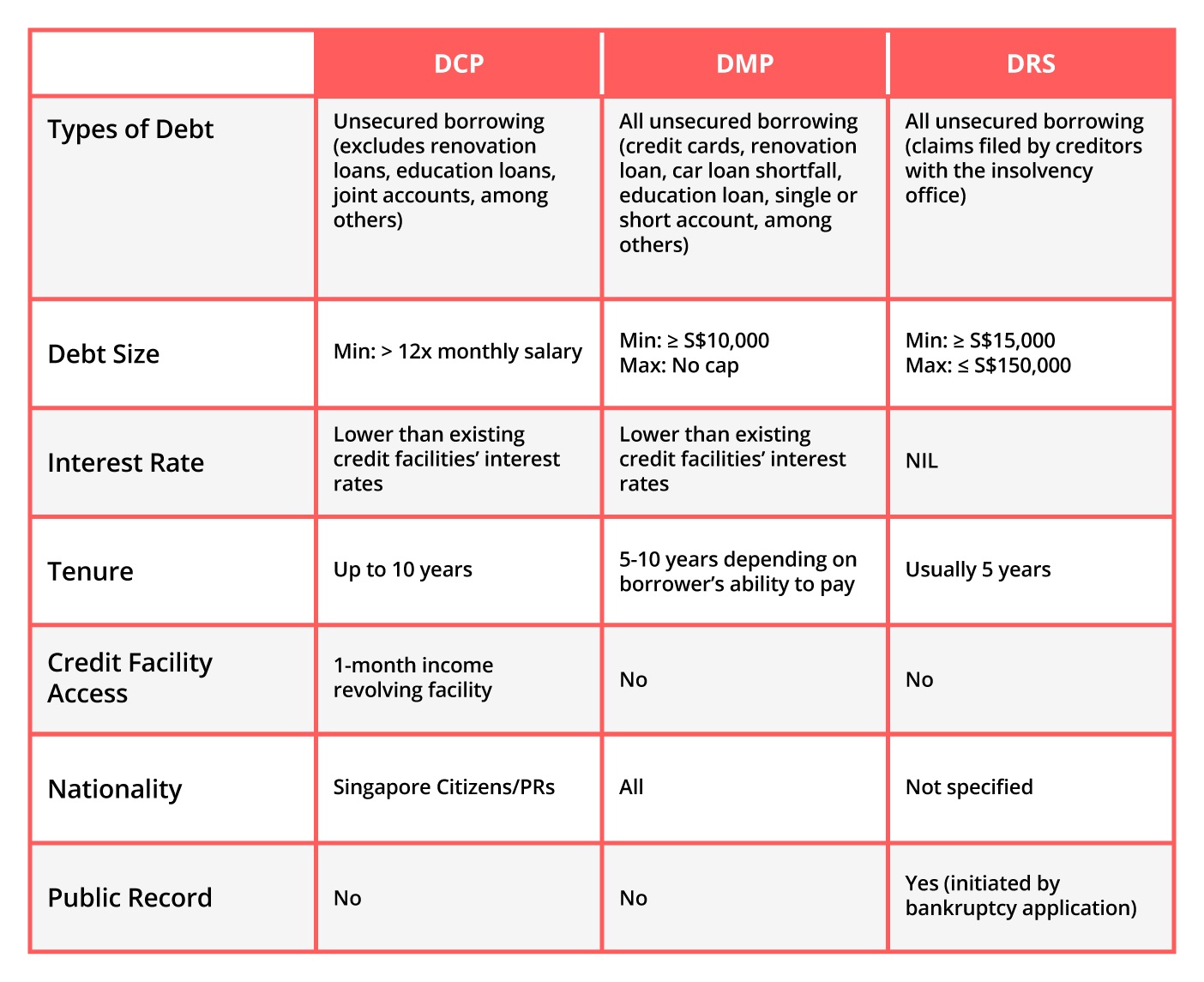

When considering debt loan consolidation strategies, it is essential to examine the numerous choices readily available to identify one of the most appropriate approach for your financial scenarios. Financial obligation consolidation includes combining several financial debts right into a single financing or repayment strategy, frequently with a lower interest price, to make it more convenient to settle. One typical method is to acquire a debt consolidation financing from a financial organization to pay off all existing financial debts, leaving check this site out just one regular monthly settlement to concentrate on.

An additional strategy is debt monitoring through a credit scores therapy firm. These companies collaborate with lenders to work out lower rate of interest or month-to-month settlements on your part. debt management plan singapore. Nevertheless, it's crucial to research and pick a reputable agency to prevent frauds or more financial problems

Discovering financial debt consolidation methods allows individuals to simplify their financial obligation repayment, possibly minimize interest prices, and work in the direction of monetary liberty.

Monitoring and Changing Your Plan

Preserving a vigilant eye on your debt monitoring method is vital for lasting financial success. Consistently monitoring your strategy enables you to track your development, determine any type of inconsistencies from the original technique, and make required modifications to remain on program in the direction of check my blog achieving your financial goals. One efficient method to check your strategy is to set specific milestones or checkpoints at regular periods, such as monthly or quarterly evaluations. During these evaluations, assess your existing monetary situation, compare it to your preliminary objectives, and review the performance of the approaches you've applied.

Life scenarios, economic priorities, and unforeseen expenses can all influence your debt management approach. Remember, a responsive and vibrant strategy to tracking and readjusting your financial debt monitoring strategy is crucial to lasting monetary security.

Verdict

Finally, developing a customized financial debt monitoring strategy is vital for attaining monetary liberty. By evaluating your existing financial situation, establishing sensible financial obligation settlement goals, creating a customized budget plan, checking out financial debt consolidation approaches, and monitoring and adjusting your plan as required, you can properly manage your debts and work in the direction of a debt-free future. It is very important to prioritize monetary stability and make notified choices to enhance your total financial well-being.

In the pursuit for financial liberty, the value of a well-crafted debt management plan can not be overemphasized. By adhering to a tailored budget plan, individuals can take control of their economic situation, decrease debt, and progression in the direction of financial liberty.

Keep in mind, a vibrant and receptive approach to surveillance and readjusting your financial obligation management plan is crucial to long-lasting financial security.

In verdict, developing a tailored financial debt management strategy is essential for attaining monetary freedom. By assessing your current monetary situation, establishing practical debt settlement goals, producing an individualized budget strategy, discovering financial debt consolidation methods, and surveillance and changing your strategy as required, you can efficiently manage your financial debts and work towards a debt-free future.